Do You Charge Sales Tax On Services In Mississippi . as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. find out the sales tax rates for different types of businesses in mississippi, such as retail, wholesale, construction, public. while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. Does mississippi impose a sales tax? here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. Yes, mississippi imposes a tax on the sale of tangible personal property and.

from www.vaporbeast.com

while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. Yes, mississippi imposes a tax on the sale of tangible personal property and. here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. Does mississippi impose a sales tax? find out the sales tax rates for different types of businesses in mississippi, such as retail, wholesale, construction, public.

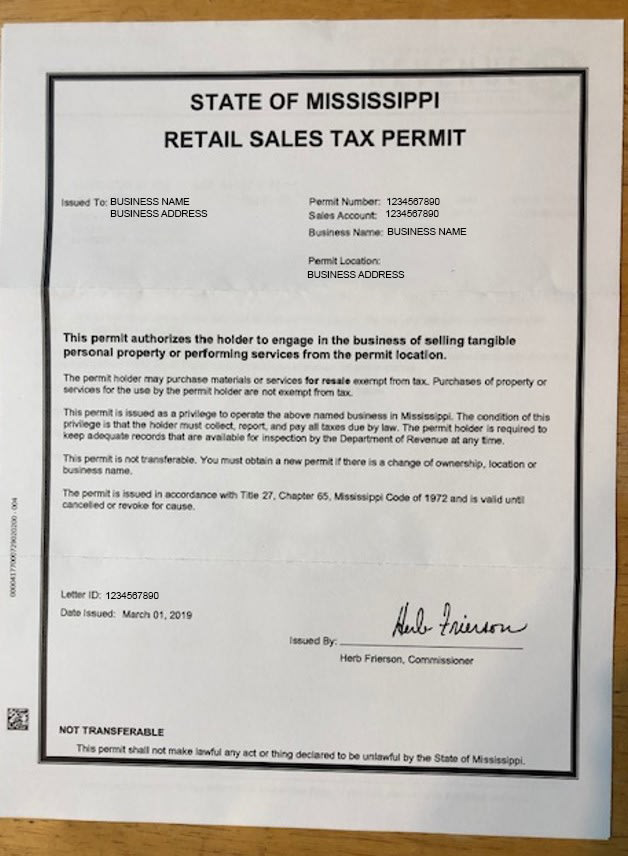

PACT Act Document Requirements

Do You Charge Sales Tax On Services In Mississippi here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. Yes, mississippi imposes a tax on the sale of tangible personal property and. find out the sales tax rates for different types of businesses in mississippi, such as retail, wholesale, construction, public. as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. Does mississippi impose a sales tax? while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%.

From thompsontax.com

Mississippi Direct Pay Computer Software & Software Services Do You Charge Sales Tax On Services In Mississippi Yes, mississippi imposes a tax on the sale of tangible personal property and. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. here’s what merchants need to. Do You Charge Sales Tax On Services In Mississippi.

From lakeshiapenn.blogspot.com

mississippi state tax rate 2021 Lakeshia Penn Do You Charge Sales Tax On Services In Mississippi as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. Does mississippi impose a sales tax? Yes, mississippi imposes a tax on the sale of tangible personal property and.. Do You Charge Sales Tax On Services In Mississippi.

From www.vaporbeast.com

PACT Act Document Requirements Do You Charge Sales Tax On Services In Mississippi Yes, mississippi imposes a tax on the sale of tangible personal property and. as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. while mississippi's. Do You Charge Sales Tax On Services In Mississippi.

From freetaxweekend.com

Mississippi Sales Tax Holiday 2018 coming this weekend Tax Free Do You Charge Sales Tax On Services In Mississippi learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. find out the sales tax rates for different types of businesses in mississippi, such as retail, wholesale, construction, public. . Do You Charge Sales Tax On Services In Mississippi.

From www.zrivo.com

Mississippi Sales Tax 2023 2024 Do You Charge Sales Tax On Services In Mississippi while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. Does mississippi impose a sales tax? as a business selling taxable goods or services in mississippi, you must register for. Do You Charge Sales Tax On Services In Mississippi.

From www.pdffiller.com

Fillable Online Mississippi Sales And Use Tax Form. Mississippi Sales Do You Charge Sales Tax On Services In Mississippi as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. Does mississippi impose a sales tax? Yes, mississippi imposes a tax on the sale of tangible personal property and. here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax. Do You Charge Sales Tax On Services In Mississippi.

From blog.accountingprose.com

Mississippi Sales Tax Guide Do You Charge Sales Tax On Services In Mississippi here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. Yes, mississippi imposes a tax on the sale of tangible personal property and. find out the sales tax rates for different types of businesses in mississippi, such as retail, wholesale, construction, public. as a. Do You Charge Sales Tax On Services In Mississippi.

From jordanbrokeit.blogspot.com

mississippi tax brackets Pauletta Kaiser Do You Charge Sales Tax On Services In Mississippi Yes, mississippi imposes a tax on the sale of tangible personal property and. here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. Does mississippi impose a sales. Do You Charge Sales Tax On Services In Mississippi.

From www.exemptform.com

Mississippi Sales And Use Tax Exemption Form Do You Charge Sales Tax On Services In Mississippi here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. find out the sales tax rates for different types of businesses in mississippi, such as retail, wholesale, construction, public. Yes, mississippi imposes a tax on the sale of tangible personal property and. while mississippi's. Do You Charge Sales Tax On Services In Mississippi.

From www.pinterest.com

Chart 3 Mississippi State and Local Tax Burden vs. Major Industry FY Do You Charge Sales Tax On Services In Mississippi as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. Does mississippi impose a sales tax? learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. Yes, mississippi imposes a tax on the sale of tangible personal property and.. Do You Charge Sales Tax On Services In Mississippi.

From salestaxusa.com

Mississippi Sales Tax Tax Rate Guides Sales Tax USA Do You Charge Sales Tax On Services In Mississippi while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. . Do You Charge Sales Tax On Services In Mississippi.

From taxfoundation.org

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation Do You Charge Sales Tax On Services In Mississippi learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. Yes, mississippi imposes a tax on the sale of tangible personal property and. here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. Does mississippi. Do You Charge Sales Tax On Services In Mississippi.

From taxfoundation.org

State and Local Sales Tax Rates, Midyear 2021 Tax Foundation Do You Charge Sales Tax On Services In Mississippi Yes, mississippi imposes a tax on the sale of tangible personal property and. Does mississippi impose a sales tax? as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. while mississippi's sales tax generally applies to most transactions, certain items have special treatment in many states. learn about. Do You Charge Sales Tax On Services In Mississippi.

From www.deskera.com

A Complete Guide to Mississippi Payroll Taxes Do You Charge Sales Tax On Services In Mississippi here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. Does mississippi impose a sales tax? find out the sales tax rates for different types of businesses in mississippi, such as retail, wholesale, construction, public. Yes, mississippi imposes a tax on the sale of tangible. Do You Charge Sales Tax On Services In Mississippi.

From 1stopvat.com

Mississippi Sales Tax Sales Tax Mississippi MS Sales Tax Rate Do You Charge Sales Tax On Services In Mississippi learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. Does mississippi impose a sales tax? as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. find out the sales tax rates for different types of businesses in. Do You Charge Sales Tax On Services In Mississippi.

From greenpeaktax.com

Green Peak Tax Services Mississippi Tax Services Do You Charge Sales Tax On Services In Mississippi Does mississippi impose a sales tax? here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. while mississippi's sales tax generally applies to most. Do You Charge Sales Tax On Services In Mississippi.

From www.vatupdate.com

Mississippi to Charge Sales Tax on Computer Software and Digital Do You Charge Sales Tax On Services In Mississippi here’s what merchants need to know about taxing services in the state of mississippi, which has a state sales tax rate of 7%. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. as a business selling taxable goods or services in mississippi, you must register for. Do You Charge Sales Tax On Services In Mississippi.

From www.gobankingrates.com

Sales Tax by State Here's How Much You're Really Paying GOBankingRates Do You Charge Sales Tax On Services In Mississippi Yes, mississippi imposes a tax on the sale of tangible personal property and. learn about the regular retail rate of sales tax (7%) and the use tax for personal property acquired in mississippi. as a business selling taxable goods or services in mississippi, you must register for a seller's permit, collect sales. while mississippi's sales tax generally. Do You Charge Sales Tax On Services In Mississippi.